|

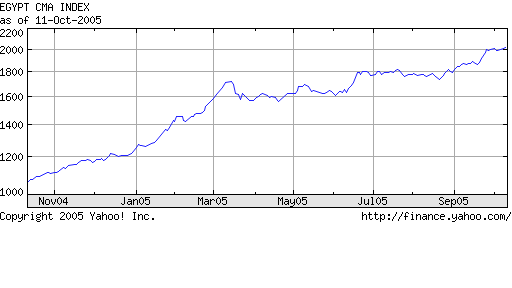

The Egyptian stock market has been one of the performing markets in the world over the past several years. Up over 100% in the past 12 months, the Egyptian market has attracted a lot of attention internationally for the market's enormous returns during this period, especially when compared to the lackluster returns experienced by many developed economies.

To truly understand the inner workings of the Egyptian economy and to understand the investment potential of this historic country, The Commodity Investor traveled to Egypt to see the world from the ground up and evaluate potential opportunities. While every culture and area of the world is different, there are always several common threads among those economies that flourished over the long term. The most important is peace. Economies that are constantly in war drain resources away from more productive enterprises. The second is law and order. Disputes must be handled in an efficient way and people must feel free to live their lives both personally and professionally, the way they see fit. A society's creativity and entrepreneurial spirit can be stifled by excessive rules and regulations. The third is a reward for innovation. The most efficient way of doing this is to allow entrepreneurs and inventors financial gain for the risks they make. Generally, this comes in the form of low taxes, especially for small businesses. Finally, the fourth is efficient capital markets. Capital must be allocated to the projects that can achieve the highest return. The more highly developed the banking sector, the greater the number of productive enterprises that can be established. When government controls the allocation of money, it often ends up in the pockets of the well connected, who waste it on projects that offer little, if any returns. Using this as a background for what to look for, we can therefore evaluate the Egyptian economy. Peace To the west of Egypt lies Libya, a country that in recent months has laid down their arms to the United States. The western border is therefore currently undergoing peaceful times. To the south, however, is Sudan, currently one of the most dangerous places in the world. The mass genocides in Darfur have caused strict border controls all around the country, and tensions run high along the Sudanese-Egyptian border. Sudan is just another example of the United Nation's complete incompetence in peacekeeping events. Countries spend billions of dollars of our money every year creating this 'international watchdog' organization that has become so complacent, it won't even intervene in Zimbabwe, where the current president just declared himself President for life with complete ability to alter the constitution as he wishes and has burned down the houses of millions of people. This kind of inaction can not be tolerated, and won't be tolerated for much longer. Already countries have realized that the UN has become too bureaucratic to justify the billions of dollars that are being spent on it. Years ago, a similar organization called the League of Nations was established for exactly the same purpose. This organization disappeared once the population realized that it essentially served no purpose. The UN is headed for the same fate. This supposed 'international watchdog' has failed at every step, from Rwanda to Zimbabwe to Sudan to Myanmar to Angola. The Sinai peninsula is a matter of dispute still despite Egypt's purchase of the land from Israel a decade ago. This is an area of great hope for Egypt. Sparsely developed with tourst attractions such as Sherm-El-Sheik and a lot of oil in the ground, the Sinai peninsula purchase was a great acquisition for Egypt. Law and Order Although Egypt may not be fighting any external wars at the moment, the number of military and law enforcement officials in the country is astronomical. Every street corner is lined with cops directing traffic. On a single bus ride that lasted just a few short hours, our bus was stopped at six military outposts. This was rather disturbing. My passport was just as valid the first time I showed it as the sixth. The necessity for such invasiveness proved to do little besides scare valuable tourists and investors. While every law enforcement official was severely underpaid, the sheer number of them made me realize how much money the government is spending on law enforcement. Little wonder their currency has declined by eightfold against the US Dollar in the past twenty years. The only way to pay for such a ridiculous number of government employees is to print money, making the value of each Pound decline significantly. An unstable currency is a bain of international investors, and before Egypt can think of attracting more outside capital, it has to get its deficits and expenditures under control. From the looks of things, they have not done that. Perhaps the most discouraging part of the entire trip was the untrustworthiness of the people in Egypt. Not one of them could be taken at their word. Every item for sale is negotiable, so foreigners get screwed on virtually everything. Taxi drivers refused to take us to certain hotels if they did not offer the driver kickbacks. We were constantly lied to and harassed by the locals who wanted to sell us anything and everything. There is an unwritten code that any local who contributes to the sale of an item receives commission on that purchase. Virtually 100% of Cairo's population then works in the tourist industry. If tourists stop coming, because of a recession or for whatever reasons, the entire economy of Egypt will collapse. Capital Markets On our last day in Cairo, we had planned on spending lots of money on souvenirs in Khan El-Khalili, the largest outdoor market in Cairo. I attempted to remove several hundred dollars from my savings account to make these purchases. It took over three hours and visiting over six different banks before I was finally able to make this withdrawl. Spending money in this country was not easy. Conclusions Despite the Egyptian stock markets phenomenal returns of the past few years, I can not recommend Egypt as a place to invest. The depreciation of the Egyptian Pound is destined to resume at some point as the government spends exorbitant amounts on military expenditures. Very little productive enterprise occurs in Egypt and exports are restricted basically to cotton and petroleum. The economy is largely based on tourism, making Egypt the equivalent of a super-cyclical country. International travel is highly based on economic conditions and when a recession hits, the demand for trips to Cairo will dissapate as fast the demand for luxury automobiles. I believe the recent advancements in the market occurred because of extremely depressed levels of equities in 2003 and this success will be short lived. For the time being, the best part of Egypt, will be its ancient past. |