|

This issue of the newsletter investigates a company named Eyetech Pharmaceuticals (EYET) which was just purchased by TheCommodityInvestor. Below, we break down the study of this company into two parts – the science part and the business part. This is one of the unique features of The Commodity Investor. We have the expertise to do in-depth analysis of both the scientific aspect of cutting edge medical and biotechnology companies and the background to analyze markets and balance sheets. The Science Part For those afflicted with the most serious form of macular degeneration, the past several months have given hope that their condition may soon improve due to research currently being done by several biotech companies. Among the most important developments in this sphere are two anti-angiogenic drugs, Macugen, developed by EyeTech Inc. and Lucentis, developed by biotech giant Genentech. In this article, we will try to distinguish between reality and hype, and give the reader a good sense of what to expect from each of these drugs, as well as their potential downfalls.

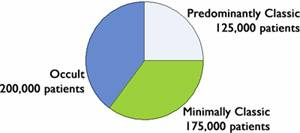

Last year, Eyetech Pharmaceuticals revealed the results of their study of Macugen on patients with wet AMD. After one year, they found that 33% of patients had maintained or improved vision, compared with 23% in the control group. The results of the Lucentis study found that 95% of patients had maintained or improved vision compared with 62% in the control group. The results seem to be indicate that Lucentis is the drug of choice for the future treatment of wet macular degeneration. In reality, however, this may not be the case. The phase III study done on Lucentis used a very specific group of people. None of them were in the predominantly classic category, thus removing the most complicated patients from the set. In addition, none of the patients could have previously used the Visudyne photodynamic therapy prior to starting this study. All this led to a much higher percentage of success even in the control group of the Lucentis study vs. the Macugen study (62% vs. 23%). This begs the question, had the same group been given Macugen as opposed to Lucentis, could their numbers have been as high? Later on, Genentech revealed results from a phase I/II study with Lucentis in combination with Visudyne. While Visudyne only treats the predominantly classic case of wet MD, the combination of the two therapies did seem to be effective. Unfortunately, there were several side effects of note. In particular, uveitis and endopthalmitis, a serious ocular condition. In addition, when Lucentis was taken by itself, hemorrhaging, eye pain, and floaters were observed. Although these were rare, they did occur in a couple of cases. The benefit of Macugen is that there have been virtually no side effects to date using this drug. Although both drugs work by blocking the growth of blood vessels, they are some inherent differences. Lucentis, is an antibody fragment of the anti-angiogensis drug Avastin, while Macugen is modified strand of RNA. Both drugs attach to the protein Vascular Endothelial Growth Factor (VEGF) rendering it unable to help create new blood vessels. This works great if you can control exactly which blood vessels you want to inhibit. But if you were to inhibit the growth of blood vessels to the heart, you could severely increase your chance of having a heart attack as a byproduct. Macugen circumvents this problem by only targeting the 165 isomer of VEGF, which is only found in the retina. Lucentis, on the other hand, is unable to specifically target which blood vessels to control. If the drug were to leak out into other places in the body, the results could be quite damaging. At the moment, both drugs are injected by a needle into the eye, and without any long term studies on the effects of these drugs, its difficult to tell what the chances are that adverse effects could occur over long periods of time. Given the fact that Lucentis targets all the isomers of VEGF, a pill form of this protein will never occur, while this is a distinct possibility for Macugen. If Macugen can eventually develop into a form that can be injested orally, this would enable patients to take the medication without seeing a doctor and incuring eye injections every few weeks. This possibility may be Macugen's trump card. Currently, Macugen is available for use and approved by the FDA, while Lucentis should be available next year. It is clear that the risks for Lucentis are much greater than they are for Macugen, but in addition, it may also provide more benefits. I think with time, we will see the two drugs being used in combination. Perhaps Lucentis will be used for the first year or so of treatment, with Macugen being the standard used for the rest of the patients treatments. In addition, I believe those that experience side effects from Lucentis or who have a history of heart disease or thrombosis should stick with Macugen. The Business Part When news was released of Genentech’s (DNA) Lucentis study, Eyetech Pharmaceuticals (EYET) stock dropped like a hammer. Already down 50% by that point, it dropped from the mid twenty’s to the low teens. The market capitalization of the company tumbled to about $500 Million dollars, almost a quarter of its value 6 months ago. Unlike Genentech, this company is a one shot deal. This drug makes or breaks the company. Already, sales of the drug have quadrupled from a year ago. Pharmaceutical companies are akin to software companies – all the expenditures go in to actually developing the product, while the manufacturing of it has minimal costs. Any increase in sales therefore, goes straight to their bottom line, making it a very profitable business. Each dose of this drug costs about 12 cents to manufacture, and is sold for $1,200 per injection. Each patient who takes Macugen treatment must get an injection every 6 weeks. This adds up to a lot of money. Add on top of all this, that Medicaid will be paying for 90% of these patients, EYET seems to be a recession proof company. This is of course, assuming that I analyzed the scientific part correctly. EYET is expecting 2005 sales to reach close to $200 Million versus around $50 Million from a year ago. This will only climb as more and more doctors become convinced that the therapy is effective in combating macular degeneration. The problem with most biotech companies at this point is that they are very richly valued. With the unnecessary dumping of this company’s stock due to massage statistics from Genentech, this is an opportunity to get into a good company, at a great price. The Commodity Investor purchased EYET at $12.50/share. |